Cartoon Resource / Shutterstock.com

Note: This post was submitted to Student Caffé by Rebecca Safier. Rebecca writes for Student Loan Hero about education, careers, and other personal finance topics. We would like to thank her for her submission and credit her as the author of this blog post.

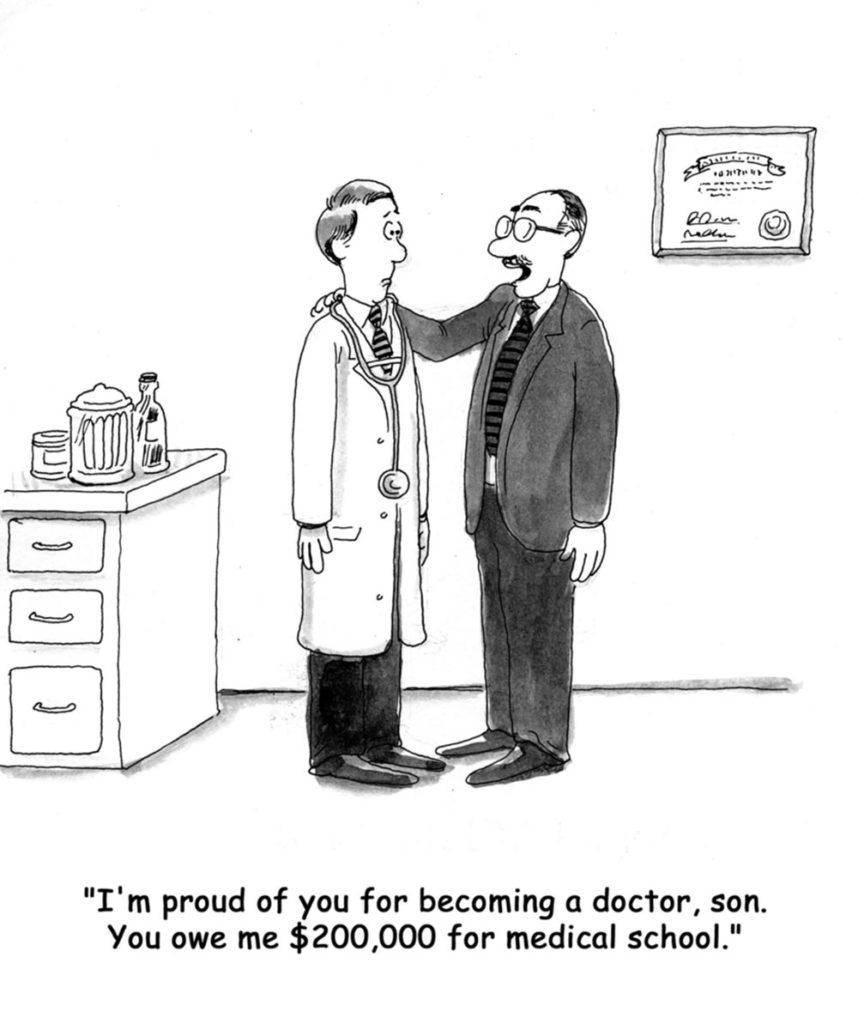

When you think of high-earning individuals, a doctor is probably one of the first professions that comes to mind. But as a medical student or new doctor, you know that a high salary is only one side of the coin. On the other side is a staggering amount of student loan debt.

According to the Association of American Medical Colleges, the average doctor graduating medical school in 2016 carried nearly $190,000 in student loans. Even if you’re making a high salary as a doctor, you can’t fully enjoy it until you pay off your debt.

So how can you manage your debt strategically while keeping interest to a minimum? Here are five “do’s” and five “don’ts” for when it comes to paying off student loans as a doctor.

Do: Keep your spending down as a student or resident.

Before you become a doctor, you usually need to spend four years in medical school and three to seven years in residency. Since you won’t be making much of an income during this time, do what you can to keep your living costs down.

For instance, you could split the cost of rent and utilities with one or more roommates. Instead of going out to eat, you could learn to cook inexpensive meals at home.

Create a budget, track your spending, and stick to your goals. That way, you can avoid one major student loan mistake: borrowing more than you need.

Don’t: Take out more student loans than you need.

As a medical student, you’re likely relying on student loans to cover the costs of tuition and fees. You might also take on extra loans to cover living expenses. But avoid taking on more debt than you need, since anything you borrow today will need to be repaid in the future—with interest.

If you’re using student loan money on fancy restaurants or vacations, think twice. And if you took out more student loans than you need, find out if you can return them. Federal loans, for instance, typically have a window of up to 120 days during which you can return the surplus money without having to pay any interest or fees.

Make sure you’re borrowing the minimum you need so that you avoid getting buried by student loan debt in the future.

Do: Make small payments during school to keep interest down.

Except for subsidized student loans, most federal and private student loans start accruing interest from the date of disbursement. Even though you don’t have to start repaying your loans while you’re still in school, making small payments could prevent your debt from ballooning.

Most loan servicers will accept small payments from students and apply them to your balance. You could choose the amount, or you could make interest-only payments while you’re in school. If you can swing these in-school payments, you can keep your balance in check.

If not, make sure you’re prepared for a student loan balance that’s quite a bit larger than the amount you initially borrowed.

Don’t: Keep your loans in deferment longer than is necessary.

When you’re in school—and for six months after you leave—you typically have a grace period during which you don’t have to pay back your student loans. Once you enter residency, you might also put your federal student loans into deferment, thereby postponing payments until you get your first job.

While deferment can be a useful tool, make sure you don’t use it for longer than is necessary. Your unsubsidized loans will continue accruing interest during deferment, causing an already large loan balance to grow even bigger.

Once you start making money, consider pulling your loans out of deferment and putting them into active repayment. If you’re worried about oppressive monthly bills, consider starting on an income-driven repayment plan or graduated repayment plan, as described below.

Do: Explore various student loan repayment plans.

Once you’re approaching repayment, take time to learn about the various plans. Federal student loans get automatically placed on the standard 10-year plan with fixed monthly payments. But they’re eligible for other plans, too.

Among your options are income-driven repayment (which caps payments at a percentage of your disposable income), graduated repayment (which starts with smaller payments that increase later) and extended repayment (which uses a longer time frame to keep monthly payments down).

Private student loans typically don’t have as much flexibility, but your lender might be able to help if you run into financial hardship. If you need relief from hefty monthly bills, speak with your lender about your options.

Don’t: Apply for income-driven or extended repayment without weighing the pros and cons.

If you have a ton of student loans, your bills on the standard plan might be too burdensome for your fresh-out-of-school budget. For instance, if you owe $190,000 at a 7.60% rate, you’d have to pay $2,265 each month on the 10-year plan. As a new doctor, this might be too much for you to handle.

In that case, consider applying for an income-driven or extended repayment plan. As mentioned, income-driven plans adjust your bills to fit your income, and both plan types extend your terms to 20 or 25 years.

But before changing your repayment plan, consider the potential downsides. Not only do income-driven plans leave you in debt for longer, but they also charge more interest over the life of your loans.

What’s more, changing your repayment plan is treated as a capitalization event, meaning the interest that your loans have already accrued gets added to your balance. In essence, you end up paying additional interest on your existing interest.

While these plans offer short-term relief, they could cost you more in the long run. Although lowering your monthly payments might sound like a good idea, make sure you’ve thought through the pros and cons before you apply.

Do: Build an emergency fund and save for retirement.

Although you might be focused on managing your student loans, don’t forget about other financial priorities. Besides managing your debt, it’s also important to build an emergency fund and save for retirement.

Most experts recommend saving enough to cover three to six months’ worth of living expenses. This financial cushion will help if an emergency strikes. It could also give you some leeway if you want to change jobs.

Besides putting money into savings, you should also funnel some of your paycheck into a tax-advantaged retirement savings account, such as a 401(k) or IRA. Compound interest means your savings will grow over time, so the earlier you can start, the better.

Don’t: Increase your spending when you start making a salary.

After years of living as a student, it’s probably tempting to treat yourself when you start bringing home big paychecks. But while you should celebrate your accomplishments, don’t forget about your other financial priorities.

If you increase your spending too quickly, your money could disappear before you know it. Instead of upgrading your lifestyle right away, consider throwing that extra money at your student loans or emergency fund. Even though you might have to live like a student a few years longer, you could also shave years off your student debt.

Do: Consider refinancing student loans for a lower rate.

Once you have a stable income and strong credit score, you could consider refinancing your student loans for a lower rate. By snagging a lower interest rate, you could potentially save thousands of dollars on your debt.

Plus, you can choose new repayment terms, whether you select a shorter term to get out of debt ahead of schedule or a longer term to lower your monthly payments. Finally, refinancing could let you combine multiple loans into one, which could make them easier to track.

Although refinancing isn’t right for everyone, it can be a useful strategy for saving money on interest.

Don’t: Sacrifice federal protections you might need in the future.

If you’re considering refinancing your student loans, however, make sure to learn about the advantages and disadvantages of doing so.

When you refinance federal loans, you essentially turn them into a single private loan. As a result, you lose access to federal protections, such as income-driven repayment plans and forgiveness programs. If you’re relying on either, refinancing might be a mistake.

If you’re confident you can manage the monthly payments, though, refinancing could be a very financially savvy move.

Finding the best strategies to manage your student loans:

When it comes to managing student loans, avoid mistakes that could keep you in debt for longer than you need to be. Work to find ways to make extra payments or lower your interest rate, so you can save money and pay off your student debt ahead of schedule.

And if you work in public service or for an otherwise eligible employer, you could also qualify for student loan forgiveness or repayment assistance.

Everyone’s situation is different, so make sure to explore student loan repayment strategies that could help you cure yourself of debt once and for all.

-

How to Recognize and Avoid Student Loan Repayment Scams

-

How to Become an Ex-Cosigner on a Student Loan

-

What to Know about Your Student Loan Grace Period

-

What You Need to Know about PSLF before Taking a Public Service Job

-

Seven Differences Between Federal and Private Loans

-

Seven Mistakes You Shouldn’t Make with Student Loans

-

How to Spot a Student Loan Repayment Scam

-

Four Ways to Cure Medical Student Loan Debt