marekuliasz / Shutterstock.com

During their college years, many people live with roommates in housing paid for by parents or student loans, focusing their energy on finishing school. Some have a part-time job for extra cash, but work usually takes a backseat to classwork. After graduation, though, priorities shift. Your budget while you’re in school is likely to be very different from your budget once you start earning a salary.

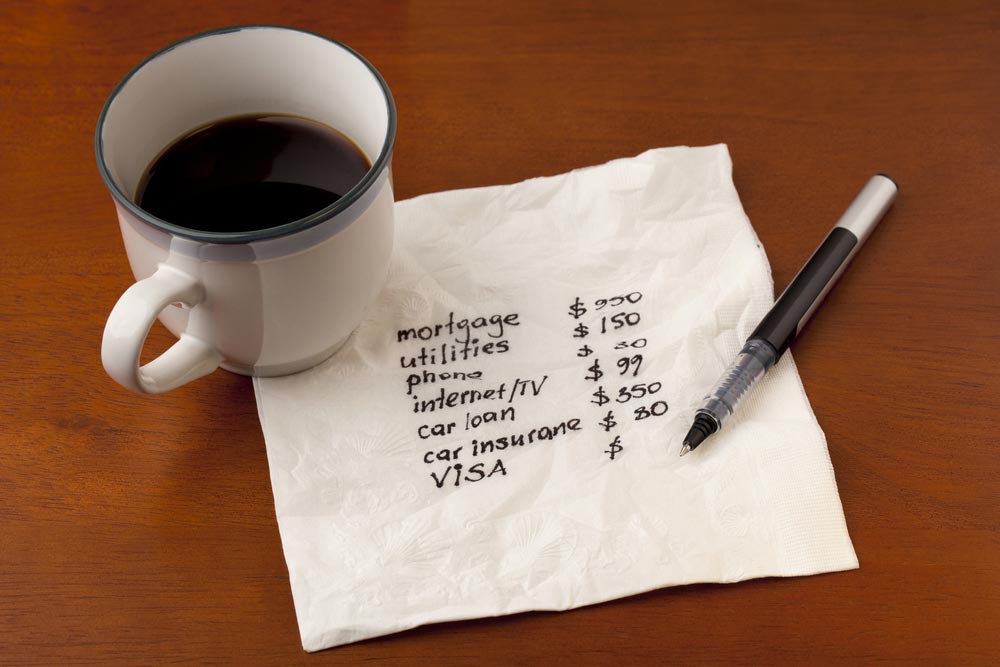

So, once you graduate and join the workforce, what should your budget look like? Obviously, it depends largely upon your income and where you’ll be living. Here are some basics:

Housing: Ideally less than 30% (but definitely less than 50%) of your take home pay should go toward rent and housing. Note that if you’re paying closer to 50%, you’ll need to tone down how much you’re spending on other areas of your budget, and you should definitely consider getting a roommate (or two) to help offset expenses. Don’t forget to factor utilities, cable, internet, and any other fees (pet rent, renter’s insurance, HOA fees, etc.) into your rent calculations; these all contribute to your housing cost and should be considered as such.

Food and Necessities: Around 10% of your income should go toward food (both groceries and dining out). Although easy to overlook—and not what you’d consider food—remember to add in things like toilet paper, paper towels, shampoo, soap, detergents, and any other items that you replenish at the grocery store; the cost of these types of items isn’t consistent each grocery store run, so you’ll need to estimate your monthly numbers here. Finally, if you find that you’re spending so much money dining out (yes, that includes your morning coffee shop run) that you are having to skimp on groceries, you should reevaluate your eating in to eating out ratio.

Savings and Retirement: Your savings account is where money for unexpected expenses (somehow they always come up) will come from, so make sure you factor savings in as a part of your budget. In months that you have unexpected costs, your savings keeps you from having to borrow money or take out a loan. In months that no unexpected expenses come up, you’ll be able to grow your savings. It’s also never too early to start thinking about retirement, especially if you don’t have a retirement plan through your employer. The more money you can save while you’re young, the better off you’ll be when you reach retirement age. Typically, experts suggest putting at least 20% of your salary toward savings (or investments or retirement funds) each month, but it may not be feasible to save that much right off the bat. Even if you can only afford to put a little bit away, always save something.

Fun: Although going to bars or having a night out would fall under this category, so would things like going to the movies, shopping for clothes, buying birthday presents, and attending concerts. This category is sometimes referred to as “discretionary spending.” The amount in this category is very individual, and obviously depends on your other expenses and your salary, but you typically won’t need to budget more than 10% or 20% of your income for fun. When you need to make concessions in your budget, this category should be where your first concessions come from. While it’s more fun to go to a concert than save for retirement, it’s more financially sound to skip the concert in months when your budget is tight.

Of course, there are other costs to consider when planning out your budget. These include:

- Transportation (car payments, parking, metro passes, gasoline, roadside assistance)

- Health insurance (including dental and vision insurance) and payment for appointments

- Prescription medication

- Loan payments

- Recurring subscriptions (Amazon Prime, Spotify, Pandora, etc.)

- Donations to charity

Tips to help you budget smartly:

- Budget based upon your after-tax income. If you make $40,000 on paper, but only take home $30,000 annually after taxes, you’ll be in quite a mess if you create a budget based on the higher amount.

- Overestimate your expenses and underestimate your income; this makes it much easier to trick yourself into always having money left over.

- Build an emergency fund early on. Force yourself to cut expenses and put money into savings so that when the unexpected comes up, you have the money to cover it.

- Pay your savings before your bills, or, in other words, treat your savings account like a bill. If you don’t pay yourself first, you’ll just end up spending that money on something else. It may help to set up automatic transfers from your checking account to your savings account each month so that you don’t even have to think about it.

- Always pay in full to avoid interest; many credit cards charge around 25% interest… is last week’s coffee really worth that much extra?

- If you can’t afford to pay in full, pay off the loans and bills with the highest interest rates first; you’ll save more money in the long run.

- Think hard about your needs vs. your wants. Then, prioritize the needs, and wait for great deals on the wants!

The easiest way to budget is to break down your spending into three categories: needs (housing, transportation, food, insurance), wants (dining out, attending concerts or sporting events, shopping for new clothes), and savings (retirement, emergency funds, repaying loans). Needs should account for 50% of your take-home pay, wants should account for 30%, and savings should account for 20%. Of course, if it’s important to you to save, switching the amounts you budget for your wants and needs categories is also an option.

How do you budget?

-

The Best Ways to Sell Your Used Textbooks

-

Six Tips to Help You Save on Teen Car Insurance

-

How to Spot a Student Loan Repayment Scam

-

How to Pinch Pennies and Save Money While in School

-

Why You Should Look at College as Your First Major Investment

-

Slow and Steady Ways to Build Up Your Savings Account

-

15 Spring Activities for a Broke College Student Budget

-

No-Fee Student Checking Accounts

-

Five Tips for Buying a Car on a Student Budget

-

Money Management Apps to Help You Stay on Top of Your Finances